Ken Morris: As investors get older, scammers get bolder

The number of senior communities springing up across the landscape is an indication of an aging society. These communities provide a safe living environment for seniors, with social activities, meals and minor medical care.

They also provide a sense of relief for those with aging parents. Knowing that mom and dad are being fed and that someone is keeping an eye on them is comforting.

But there’s a downside. The criminal element knows exactly where to find these vulnerable seniors.

It’s common that a person’s mental sharpness declines at some point in life. For example, I have a longtime client who was a top auto executive. After retirement, he was in high demand by auto suppliers. But time began to catch up with him, and as so many retirees eventually do, he moved into a senior community.

Everything was going just fine until the day he answered a phone call from an unscrupulous individual pretending to be from his bank. Believing the impostor’s story, he was swindled out of nearly $10,000. During the conversation, he was told not to answer his phone under any circumstances unless it was from the phony banker himself.

After being unable to reach him by phone all day, his family drove to the facility. It didn’t take long for them to determine that he had been taken. He was unable to provide a good explanation to his family, to the investigating police or to me, his advisor. In short, a slick talking criminal, posing as a banker, stole from a senior. Sadly, my client is not alone.

I am well aware that stealing from seniors is becoming quite prevalent. Nonetheless, I was surprised to learn that scammers cost older people $700 million in 2024. That’s according to the FTC, which defines older people as those beyond the age of 60.

In 2024, 8,269 seniors lost more than $10,000 to impostors. Quite a jump from 2022, when it was slightly under 1,800. Total losses to scammed seniors was $122 million in 2020. Last year, it was more than $700 million.

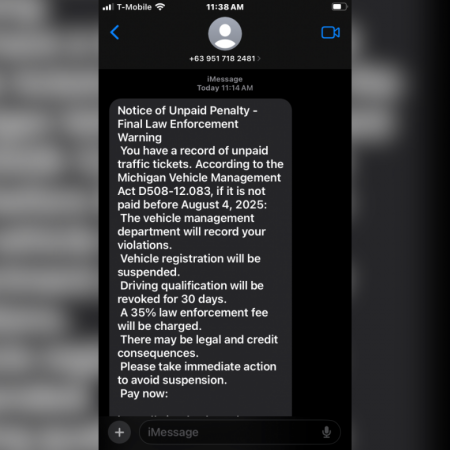

Scammers use made-up crises to trick seniors, often pretending to be someone of authority, as in my aforementioned client’s “banker.” Or maybe it’s a law enforcement officer with a cockamamie story about a grandchild who desperately and immediately needs money to get out of a dangerous situation. Using today’s technology, a scammer can make almost anything seem real, and senior citizens with money in the bank make ideal targets.

Financial advisors go to great lengths to protect vulnerable clients. We do not act on emails requesting money. Phone calls are made to clients prior to executing any withdrawal requests. If senior financial abuse or fraud is suspected, there are steps advisors can take to make certain everything is in good order before any money is withdrawn.

When opening an account, advisors document a trusted, client-designated person to whom we have permission to contact if any concerns arise.

Nowadays, there are numerous ways investors can directly manage their own funds. That may be fine, but as they age and become more vulnerable, they may lack the time, desire or ability to oversee their finances the way a financial advisor does. Having a financial advisor provides one more set of eyes on the lookout for con artists.

Email your questions to kenmorris@lifetimeplanning.com

Securities offered through Kestra Investment Services, LLC (Kestra IS), member FINRA/SIPC. Investment Advisory services offered through Kestra Advisory Services, LLC (Kestra AS), an affiliate of Kestra IS. Society for Lifetime Planning is not affiliated with Kestra IS or Kestra AS. https://kestrafinancial.com/disclosures

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Investment Services, LLC or Kestra Advisory Services, LLC. This is for general information only and is not intended to provide specific investment advice or recommendations for any individual. It is suggested that you consult your financial professional, attorney, or tax advisor with regard to your individual situation. Comments concerning the past performance are not intended to be forward looking and should not be viewed as an indication of future results.